Lend ETH and Earn Interest

Individual lenders can send loan offers to either an entire collection or a single NFT on X2Y2.

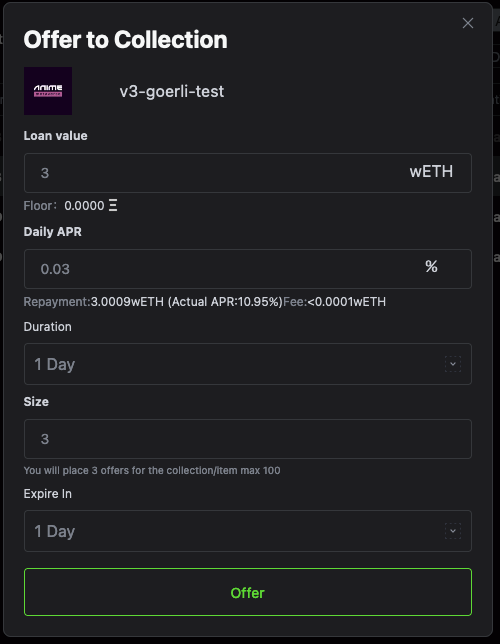

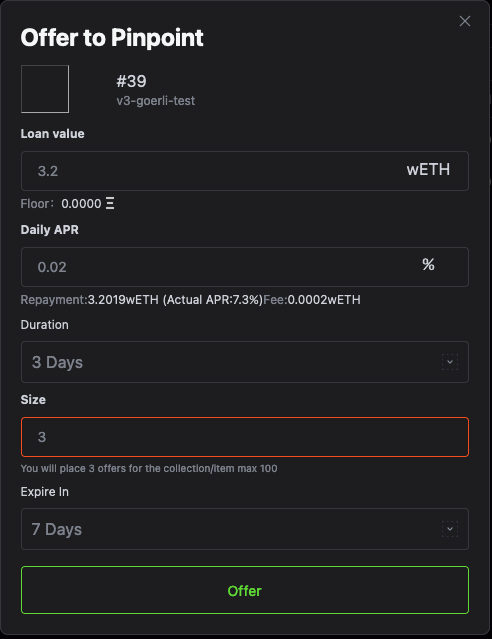

A loan offer includes the following terms:

- Loan value. The amount of ETH that the lender is willing to lend.

- Repayment value. The amount of ETH that the borrower has to repay, consisting the amount borrowed and interest.

- Duration. The amount of time the borrower could take to pay off the loan.

- The Annual Percentage Rate (APR). The annual cost of a loan to a borrower, including interest and fees, expressed as a percentage. It's used to measure how much interest will accrue on the loan value.

- Expire time. The offer invalidates after its expiration time.

Borrowers can accept your offer at any time and establish a loan with you instantly.

You can send multiple loan offers to a collection or a single item at the same time, as long as their durations are different. This can greatly improve the utilization of your ETH funds.

Collections Whitelist

At the moment, only a limited set of whitelisted collections are open to loan offers. This is because we want to avoid collections with high volatility that are more likely to result in lender losses.

If you're the owner of a collection, you can contact us to add your collection to the whitelist.

Fee Rate

Starting from March 14th, X2Y2 takes management fees with the announcement of X2Y2 Fi.

| Type | Side | Fee Rate | Example (1 ETH at APR 50% for 7 Days) |

|---|---|---|---|

| Platform fee for every loan | Lender | 10% of Interest | <0.001 ETH |

| Service fee for refinancing | Borrower | 0.2% of Principal | 0.002 ETH |

Make Loan Offers

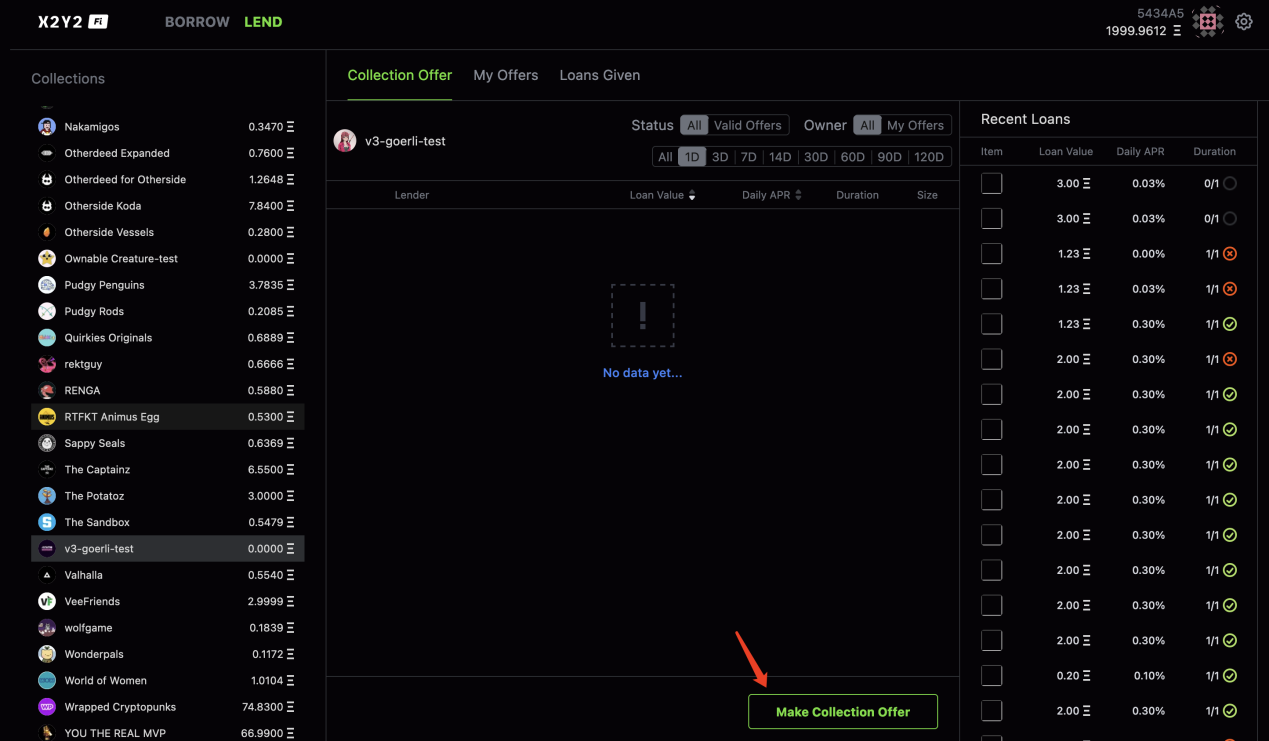

You can offer to a collection on the collection page by clicking the Make Collection Offer button.

It is worth noting that you can make configurable standing collection offers, which allows lender to set the amount of loan offers to be created under the same terms. Lenders can set the size of the collection offer under Size. This new feature can be a great time saver when placing multiple collection offers.

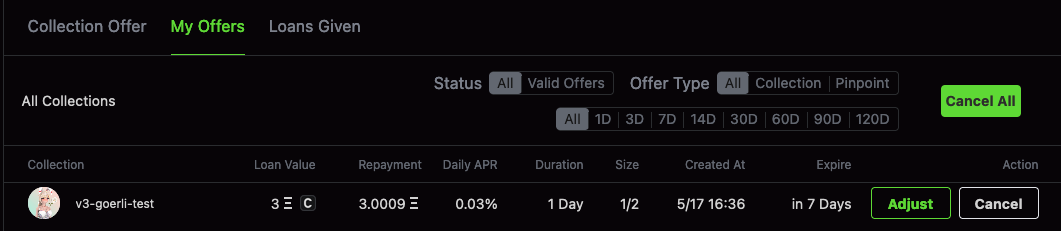

If you want to continue this offer, you can reset it on Adjust.

Or,offer to a single NFT on the NFT detail page.

Pinpoint offer:

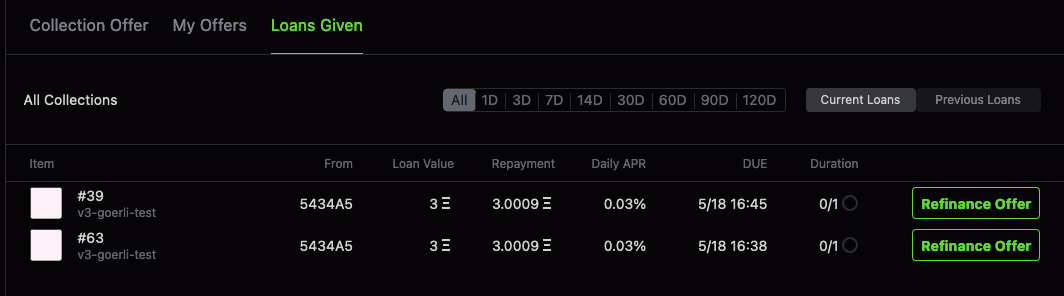

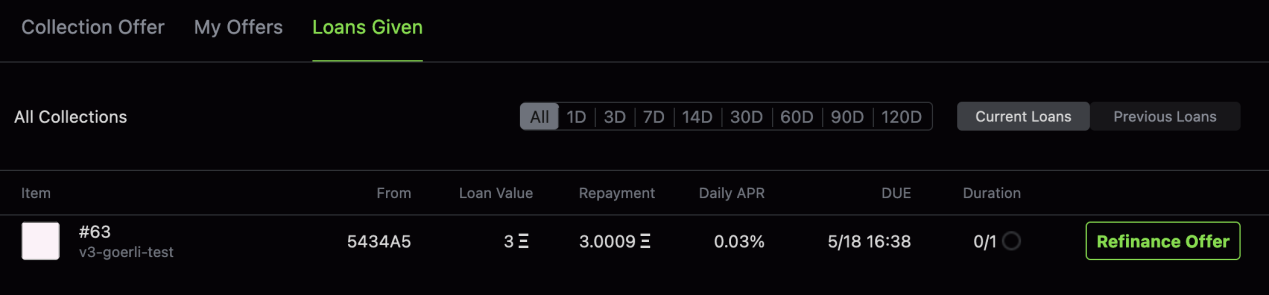

As a lender, you can see the expiration time of your offer. If you want to continue to make an offer for this NFT, you can click ‘Refinance Offer’ in the original offer that has not yet expired, and make a Pinpoint offer for this NFT.

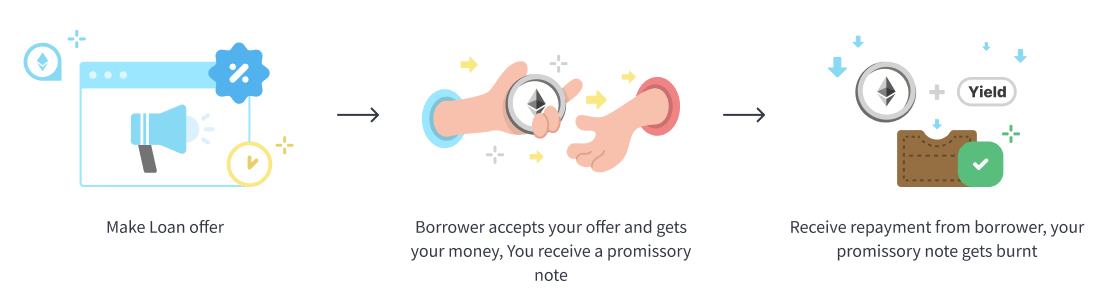

Before making offers, keep in mind that when the NFT loan gets accepted by a borrower, it will:

- Send an amount of ETH that you approved from your wallet to the borrower.

- Lock the borrower's NFT in the contract as collateral.

- Allow you to obtain the NFT collateral if the borrower fails to pay off the loan before due time.

Manage Your Offers & Loans

You can browse your valid offers and ongoing loans under the Loans tab on your Current Loans.

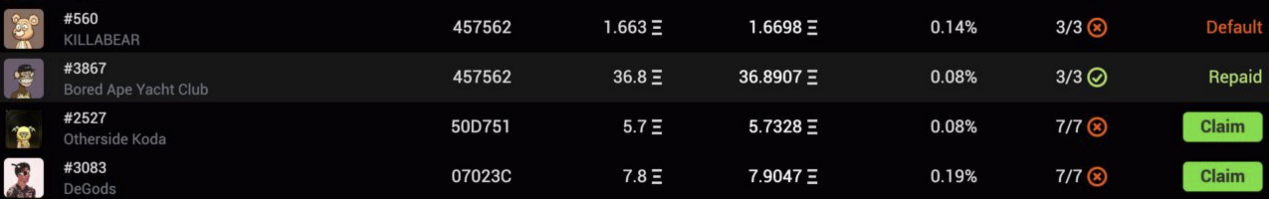

Repay & Default

If the borrower repays the loan before the due date, the NFT will be returned to them and the repayment amount minus the platform fee will be transferred to you.

In case the borrower fails to repay the loan in due time, the loan will be marked as Defaulted and can be found under the Previous Loans tab, as shown in the image above. If this happens, you can click the Claim button to claim the NFT to your wallet, as you have become the sole owner of the NFT and the loan can no longer be repaid through X2Y2.