Borrow ETH with Your NFTs

You can now borrow ETH by using your NFTs as collateral on X2Y2. This process, known as an NFT Loan, allows you to borrow from other lenders and use your NFT as collateral.

Before you can use your NFT as collateral, it must meet certain requirements:

- The NFT collection must be on the whitelist.

- The NFT must not be marked as stolen or removed on X2Y2 or other markets (such as OpenSea).

- The NFT must have received valid loan offers, which means that lenders are willing to lend you ETH against your NFT.

The collection whitelist is set up to reduce the risk of highly volatile collections. We will gradually add more collections to the list. If you want to add your collections to the whitelist, please contact us.

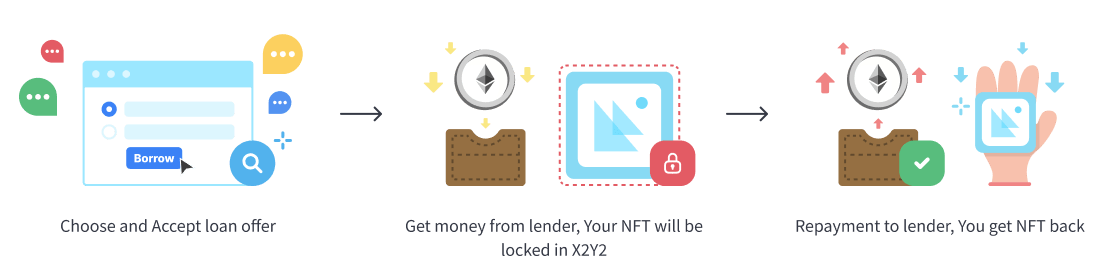

When you accept a loan offer, you establish an NFT Loan. This process involves several steps:

- An amount of ETH is sent to your wallet.

- You are required to repay an amount of ETH (the amount you borrowed plus interest) before the due time.

- Your NFT is locked in the contract as collateral until you pay off the loan.

- The lender has the right to obtain the NFT collateral if you fail to pay off the loan before the due time.

What is a Loan Offer

The loan offer is a way for lenders to show their willingness to lend you ETH based on the value of your NFT.

There are two types of loan offers based on the target types:

- Collection offers that apply to all items of one collection. Anyone possessing one item of the collection can accept the collection offer.

- Item offers that apply to a single item. Only the owner of the item can accept the offer.

A typical offer includes the following terms:

- Loan value / Principal. The amount of ETH that the lender is willing to lend.

- Repayment value. The amount of ETH that the borrower has to repay, including the amount borrowed and interest.

- Duration. The amount of time the borrower could take to pay off the loan.

- The Annual Percentage Rate (APR). The annual cost of a loan to a borrower, including interest and fees, expressed as a percentage. It's used to measure how much interest will accrue on the loan value.

- Expire time: the offer becomes invalid after its expiration time.

Fee Rate

Starting from March 14th, X2Y2 takes management fees with the announcement of X2Y2 Fi.

| Type | Side | Fee Rate | Example (1 ETH at APR 50% for 7 Days) |

|---|---|---|---|

| Platform Fee for every loan | Lender | 10% of Interest | <0.001 ETH |

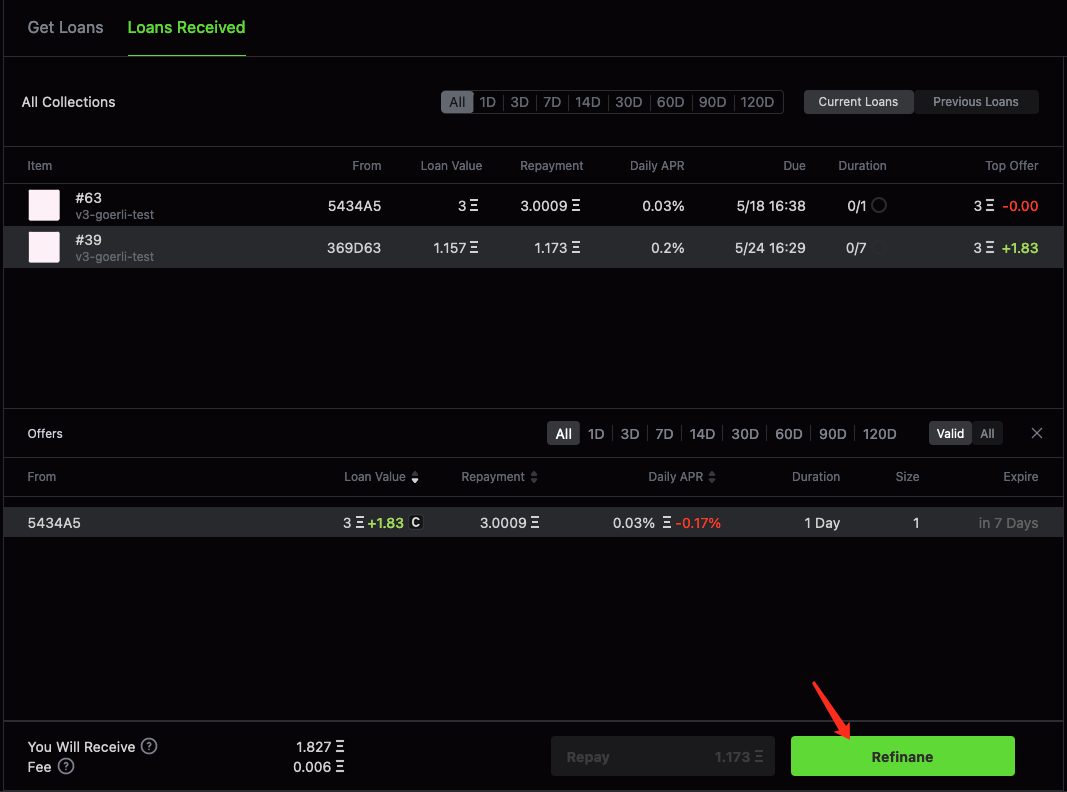

| Service Fee for refinancing | Borrower | 0.2% of Principal | 0.002 ETH |

How to Borrow ETH

To start borrowing ETH, you need to locate one of your NFTs that has received loan offers. Then you can browse loan offers the NFT received.

Accept an Offer

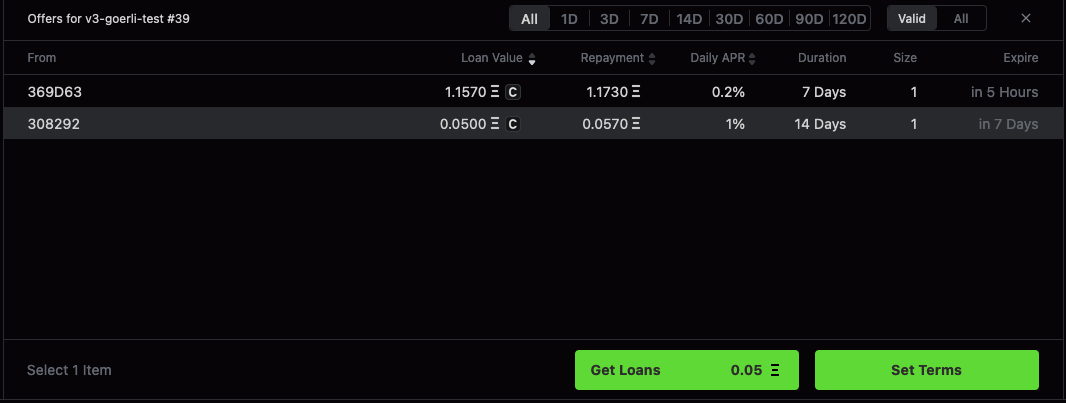

Once you've located loan offers for your NFT, you may see several options with varying loan values, APR, and duration. Take the time to consider each offer and choose the one that suits you best.

When you've decided which offer to accept, click the Get Loans button at the bottom to initiate the borrow transaction

When the transaction is successful, your NFT will be locked in the contract and ETH will be deposited into your wallet.

Repay Your Loan

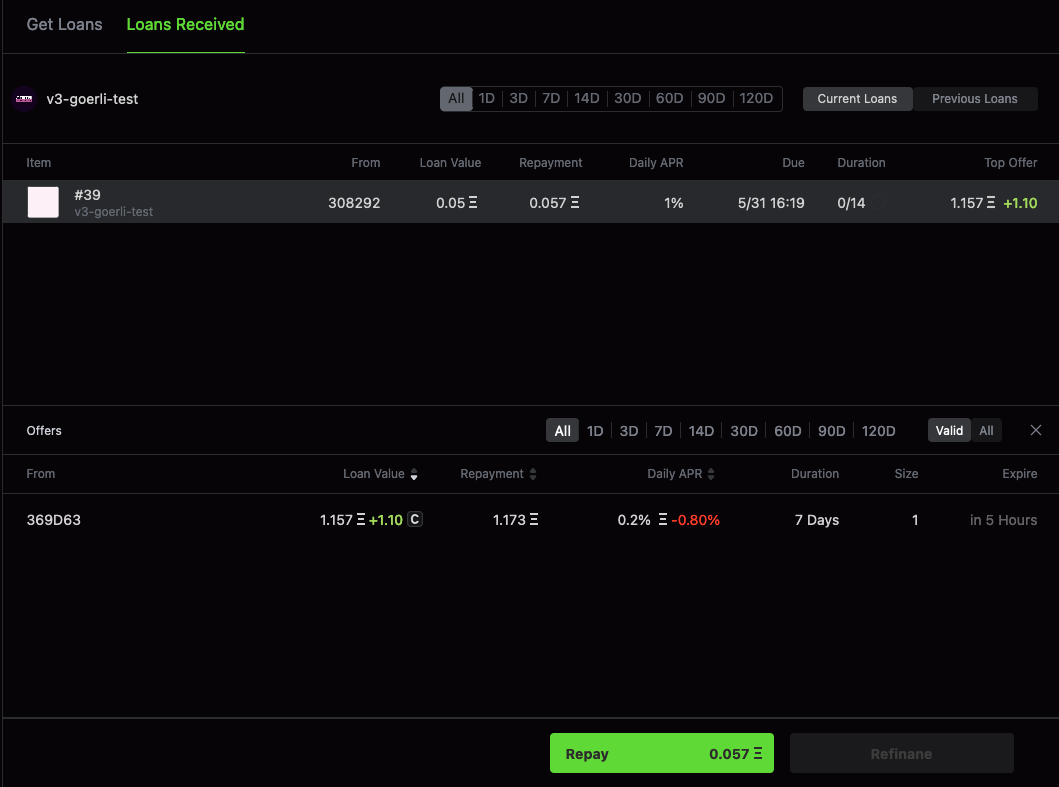

To view your ongoing loans, navigate to the "Loans Received" tab. From there, you can click the Repay button at the bottom to pay off the loan and retrieve your NFT.

If you find a better offer or you want to borrow again, you can click Refinance.

You can repay the loan at any time before the due date. However, keep in mind that the repayment value will remain the same.

Default

If you do not repay the loan by the due date, the loan will be considered defaulted. You will no longer be able to repay the loan and retrieve your NFT through X2Y2. Instead, the lender will be able to retrieve the NFT to their wallet.

Airdrop Notice

When your NFT is locked in the loan contract as collateral, any airdropped tokens for the NFT project will be sent to the loan contract. At present, there is no way to transfer these tokens out of the contract. This is a limitation of the contract that we hope to improve in the future.